This quick note will gauge the recession to come preliminarily. The recession will unfold regardless of interest rate decreases, as it always does.

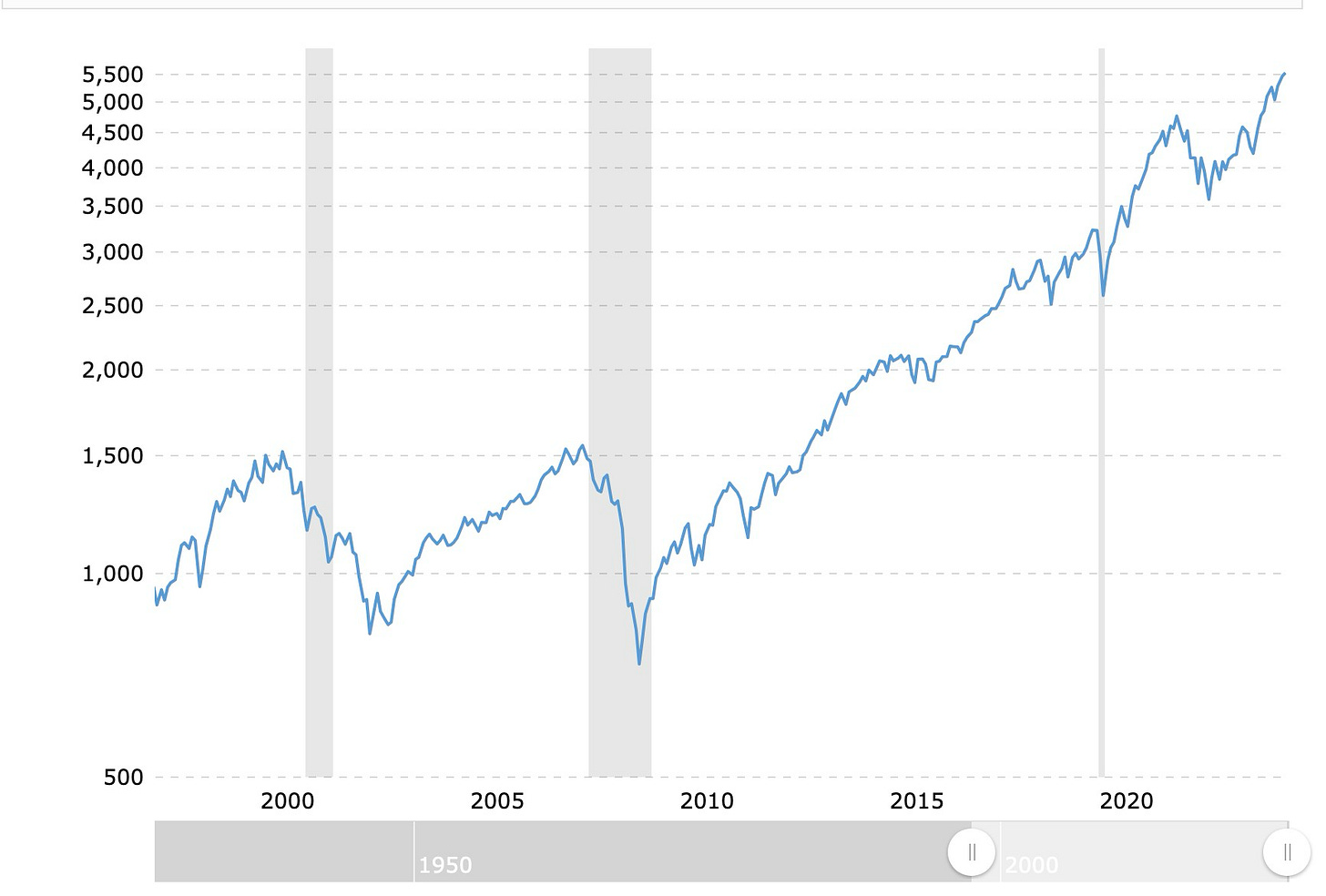

Consider the S&P 500 for the past 25 years, with attention to the more “normal” recessions and bear markets of the Dot-Com Bubble and the Great Financial Crisis, which were in the 40-50 percent decline range.

The Dot-Com bear market lasted almost two years, and the GFC bear market lasted nearly a year and a half. So, we might guesstimate that the current bear market will last two years, plus or minus six months.

As I point out in my pinned post, the Neocon global domination strategy is based on demographics. The US and North America are favored demographically. Many expect this bear market to be a correction before resuming its upward race. For an analysis of the American stock market from my favorite technical analysts, see “The Demographic Case for a Long-term Bull Market.”

Note that after both the Dot-Com bubble and the GFC, the long-term oscillator, the Coppock Curve, went negative. If the oncoming recession is as severe as either, the Coppock Curve will go negative before a long-term bull market resumes.

However, the Fed will probably engage in massive monetary stimulus, so we are in uncharted territory. Additionally, if the Neocons succeed in getting WWIII going, there will be a fiscal blow-out of unprecedented proportions. For reference, Martin Armstrong expects the economy to be in recession until 2028.

As many long-time traders say, the best thing to do in a bear market is to take up gardening.

Have a restful weekend! Pray for peace!