Recession dead ahead, and why my theory of "animal spirits" is better than the Sahm indicator

we judge everything by what we are used to

There has been a lot of bloviation about the Sahm indicator signaling a recession. “Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.”

This is an a-theoretic indicator. It’s a statistical trick identifying a turning point.

My “animal spirits” or confidence indicator is based on the oldest law in psychology: the sensitivity of all perception and cognition to adaptation level, that is, to what we are used to. I explained how I was led to develop this indicator in the post “Whither ‘animal spirits?’” published on ZeroHedge. In the 1990s, I was quoted in The Wall Street Journal on my theory.

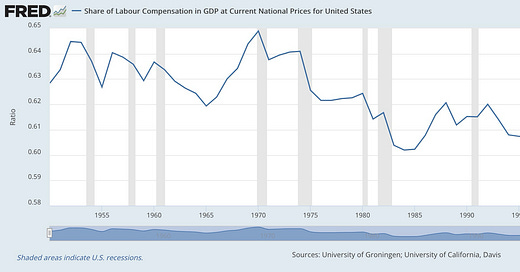

The returns generated by the US economy are split between capital and labor. The labor share has been declining for some time, which is itself anxiety-inducing, as it has been accompanied by increasing income and wealth inequality.

Capital controls management, and management controls labor. The vast majority of Americans reside in what has been called the precariat, those whose incomes are subject to revocation in a bad enough recession or depression.

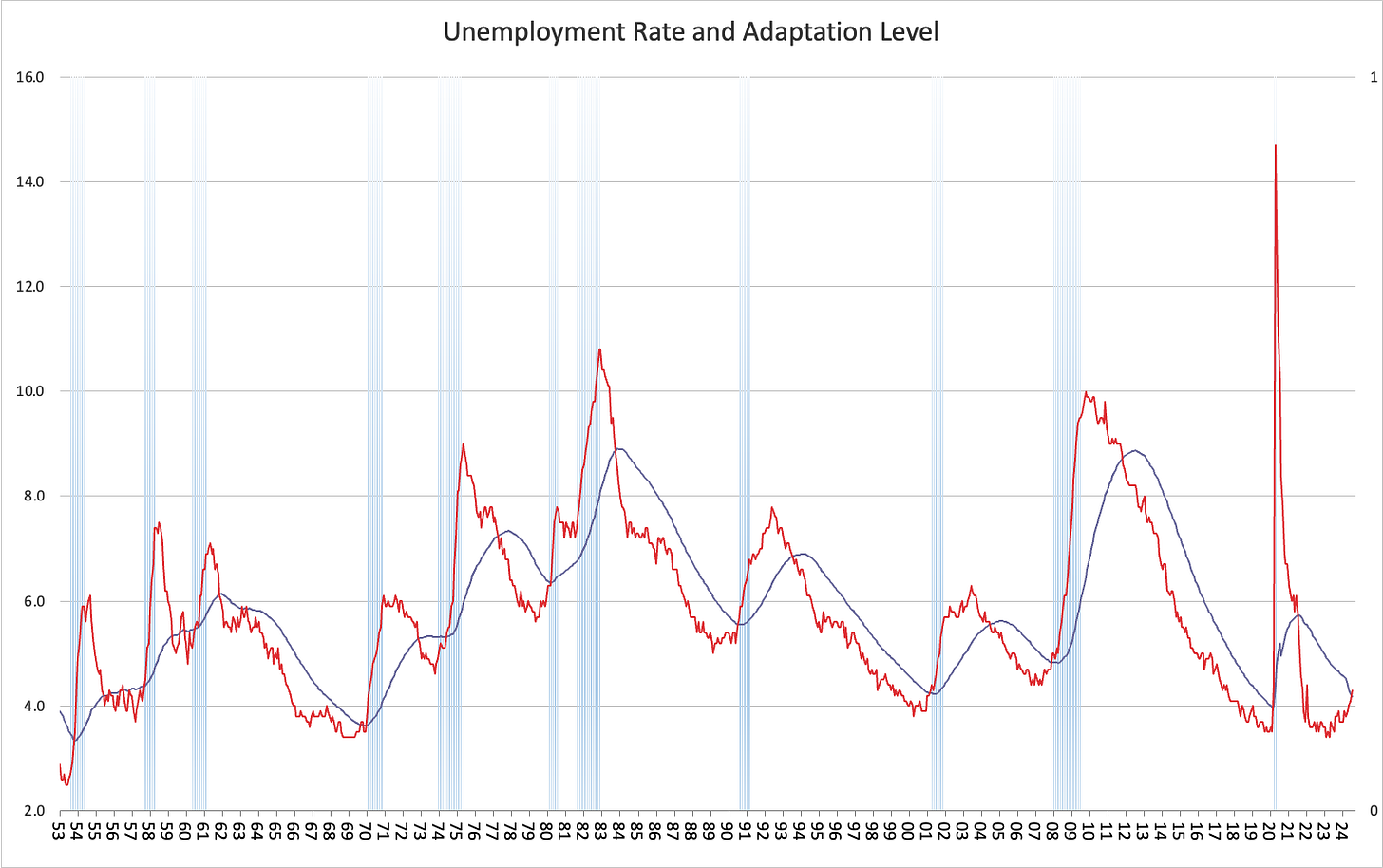

So, it is not surprising that people are extremely sensitive to the unemployment rate as a proxy measure for how much their income is at risk. And we know that the law of the business cycle has not been repealed. Over the business cycle, people will judge the current unemployment rate in terms of what they are used to, the adaptation level. The editor of the Journal of Economic Psychology, where I published this research, suggested using an exponential moving average to model the adaptation level. My measure assigns heavier weights to more recent observations over the past four years.

Here is a graph of the unemployment rate and the adaptation level up to the July unemployment rate observation. Every time the unemployment rate crosses above the adaptation level, a recession occurs. At 4.3 percent, the July rate exceeded the adaptation level of 4.18 percent.

We can turn the unemployment rate and adaptation level around to construct a confidence or “animal spirits” metric based on the amount the adaptation level is above the unemployment rate, which is when people feel good, when unemployment is “low.”

“Animal spirits” have just turned negative, which will lead to millions of decisions to consume and produce less, pulling the economy into a recession. Like the Sahm indicator, my “animal spirits” indicator has never sent a false positive.

Its superiority to the Sahm indicator is especially evident in the early 1980s, when there was a brief technical recovery from the 1980 recession before the deeper 1981-1982 recession. My “animal spirits” indicator never recovered: the unemployment rate remained high above the adaptation level, signaling that there had been no psychological recovery, no recovery of confidence levels.

The economy was not in a sustainable recovery. The recession would continue.

What if the corrupt BLS produces BS statistics in the period before the election? What if they report an unemployment rate of around 4.0-4.3 percent until the election to goose the election odds for the goose?

It won’t work, as the prior performance of my model shows.

The self-organized criticality process of loss of confidence → reduced consumption → reduced production → increased unemployment has begun and will continue until businesses reach a point where they don’t feel the need to fire any more workers, and then subsequently, will begin to hire again.

If the BLS attempts to sell the public a non-increasing unemployment rate, the suppressed unemployment will be too big to hide or kick down the road into revisions later. We are at the point in the business cycle where unemployment accelerates upward whether the BLS reports it or not, and publications like ZeroHedge will publicize big companies' layoff announcements, making the government look stupid.

As if they care.

Many indicators say that most US consumers are tapped out. Credit card charge-offs are at record levels at smaller banks.

At the largest banks, credit card charge-offs are at levels often preceding recessions.

Rent delinquencies are soaring at multifamily properties. Five months ago, Freddie Mac reported “the biggest surge in delinquencies in a decade.”

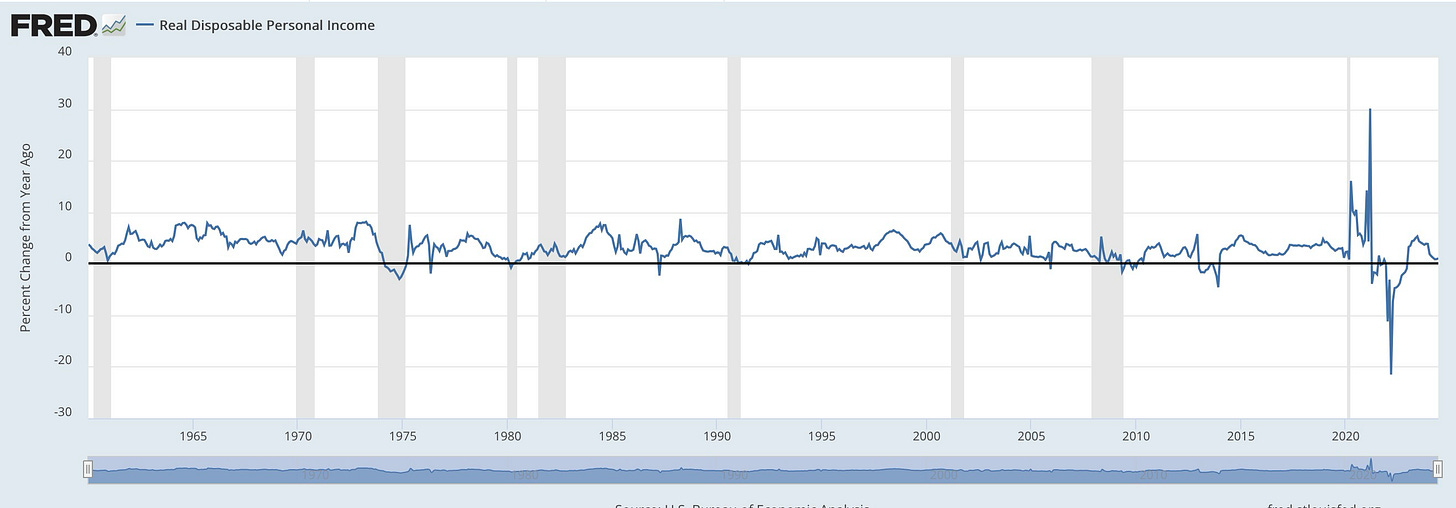

Real disposable income (if you believe the government’s number) is barely above where it was a year ago, and people still remember easy money coming in the mail with the stimmy checks. Perhaps the President (or whoever) will arrange for stimmy checks before the election for everyone, not just illegal immigrants?

Indeed.com data on the labor market are also indicating a slowdown.

Recession is dead ahead. “Animal spirits” are fading.

Have a blessed day! Pray for peace!