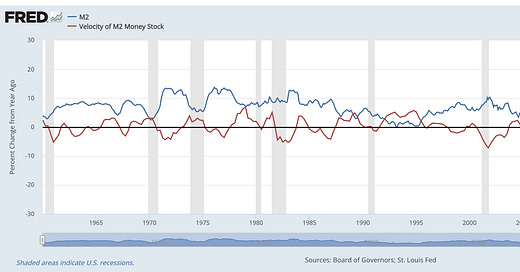

I have previously noted that, while M2 has plunged scarily, M2 velocity has accelerated to record levels, most likely as the result of the war fever gripping the Blob, even as M2 year-over-year growth has turned up again.

I was going to wait until after the unemployment report to comment, but the ADP survey result suggests we are in for more tightening to get inflation “under control,” that is, to get the recession over with before the election. I will update my “animal spirits” model tomorrow to show the unemployment rate that will be required to cause a collapse of confidence, according to my model.

Any doubt that promoting chaos in the international economic sphere is bad for the dollar should be laid to rest by the second article below from Martin Armstrong. Our Satanic overlords are going for world domination. Klaus “der Fuhrer” Schwab’s recent visit to Chairman Xi was probably to mollify him and get him back in line, as the WEF puts the squeeze on China, which is in truly dire shape (debt deflation, depression, demographic collapse).

As I showed in a recent post, going to war with China would jeopardize $500 billion of imports the US depends on to keep functioning, so it is likely that the Neocons will not start a war with China, and China is unlikely to try to take Taiwan in their current condition.

WTF! ADP Reports Massive Surge In Employment In June

BY TYLER DURDEN

THURSDAY, JUL 06, 2023 - 07:20 AM

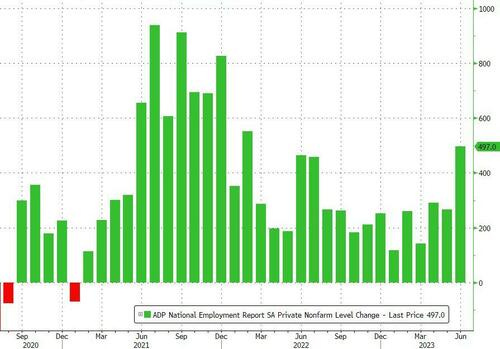

The US economy added a stunning 497k jobs in June, according to ADP's Employment Report. That's more than double the 225k expectation...

Source: Bloomberg

That is the biggest monthly jump since Feb 2022.

Goldman suggests that a distortion in the ADP seasonal factors contributed to the strength, as ADP employment growth had picked up in June in 6 of the last 7 years - and by 193k on average excluding 2020.

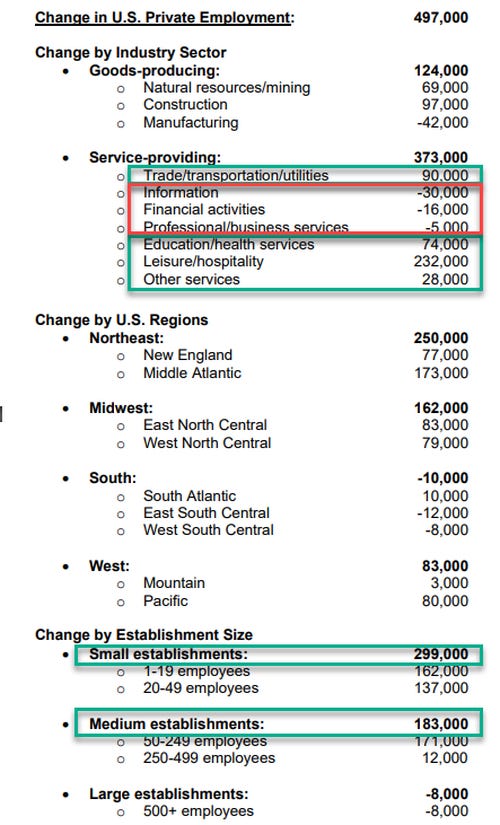

Job creation surged in June, led by consumer-facing services. Leisure and hospitality, trade and transportation, and education and health services showed strong gains. Still, the market was fragmented, with manufacturing, information, and finance showing declines.

Bear in mind that ADP has under-estimated the official BLS data for 9 of the last 11 months (and 14 of the last 17 months)...

Source: Bloomberg

“Consumer-facing service industries had a strong June, aligning to push job creation higher than expected,” said Nela Richardson, chief economist, ADP.

“But wage growth continues to ebb in these same industries, and hiring likely is cresting after a late-cycle surge.”

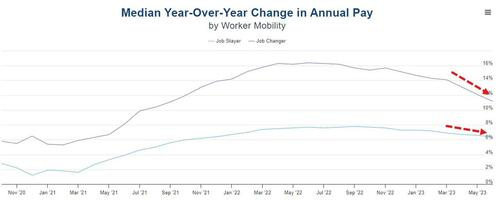

On the bright side (for The Fed), wage growth slowed:

Job stayers saw a year-over-year pay increase of 6.4 percent, down from 6.6 percent in May.

For job changers, pay gains slowed for the 12th straight month, to 11.2 percent, the slowest pace of growth since October 2021.

It should be no surprise that wage growth is slowing since almost all job growth is leisure/hospitality and trade/utilities, while high-paying Information, finance and professional jobs all declined.

Finally, claims - coming up next - are strongly diverging from this optimistic ADP perspective...

Source: Bloomberg

But, hey, a 3%-handle on 'unemployment' is good enough for the Biden administration... even if it's not helping The Fed ease off.

This huge surge is not at all what The Fed wants to see.

Martin Armstrong on the dollar:

BRIC’s to replace the dollar?

The goldbugs cling to everything they can to promote gold at the destruction of the dollar. They are pushing the idea that China, Russia, and other BRICS countries are developing a dollar alternative. The truth of the matter is that is more fiction. Even India’s foreign minister S. Jaishankar came out and said, “There is no idea of a BRICS currency.” Foreign minister S. Jaishankar made it clear that the five-member BRICS group – consisting of Brazil, Russia, India, China, and South Africa – isn’t currently planning to develop a greenback substitute for trade and investments. “On what we will discuss at the BRICS meeting, we’ll have to see because there are many other issues – but there is no idea of a BRICS currency,” he said, as shown by footage from the Hindustan Times.

To even attempt to do something is absurd to create a BRICS currency like the euro would doom their economies. The #1 market remains the American consumer, and to price things in some alternative currency would undermine their own economies. People need to understand currency.

[…]

There is always a premium to the dominant economic empire. For right now, that is the US dollar.

For now, the dollar will retain that role up to about 2029.

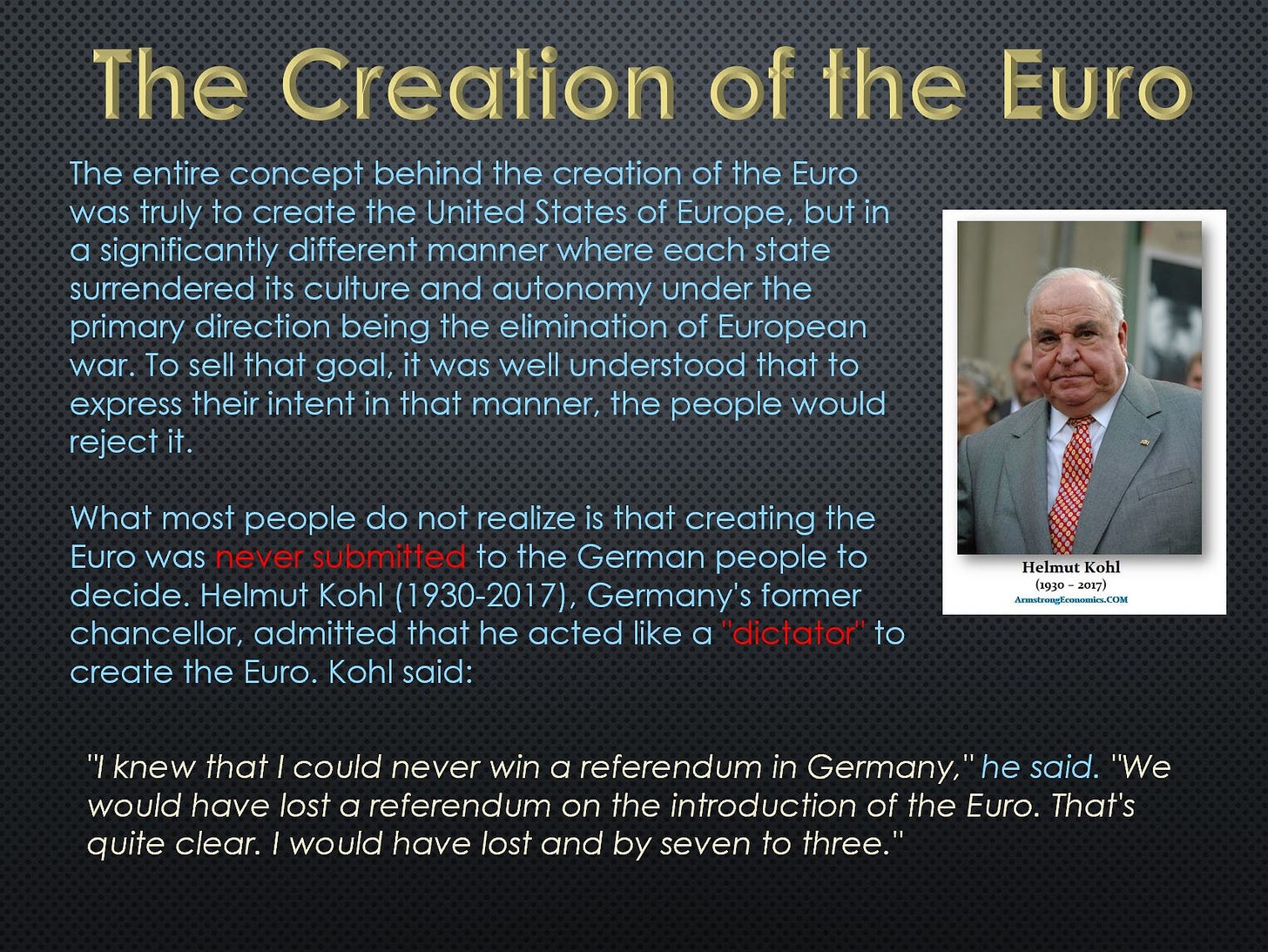

Decades ago, Armstrong correctly predicted the ultimate failure of the Euro when no provision was made to consolidate all the member countries’ debts, as US Treasury debt is consolidated against the Federal government’s power of taxation; and the states are left to pay whatever risk premium the market demands of them, without a federal guarantee. So all the talk decades about the “convergence” of EU member states borrowing rates was nonsense. Why wasn’t the EU debt consolidated? By creating the common currency, member states’ currency risk was virtually eliminated, and Germany could sell more exports. Armstrong writes:

Ultimately, the structure of the EU led to the predictable overindebtedness of member states which led to a decade of negative interest rates to enable them to raise more debt and avert collapse, now in progress.

Have a blessed day!