Peter of “Game of Trades” does a nice technical analysis of today's stock market situation.

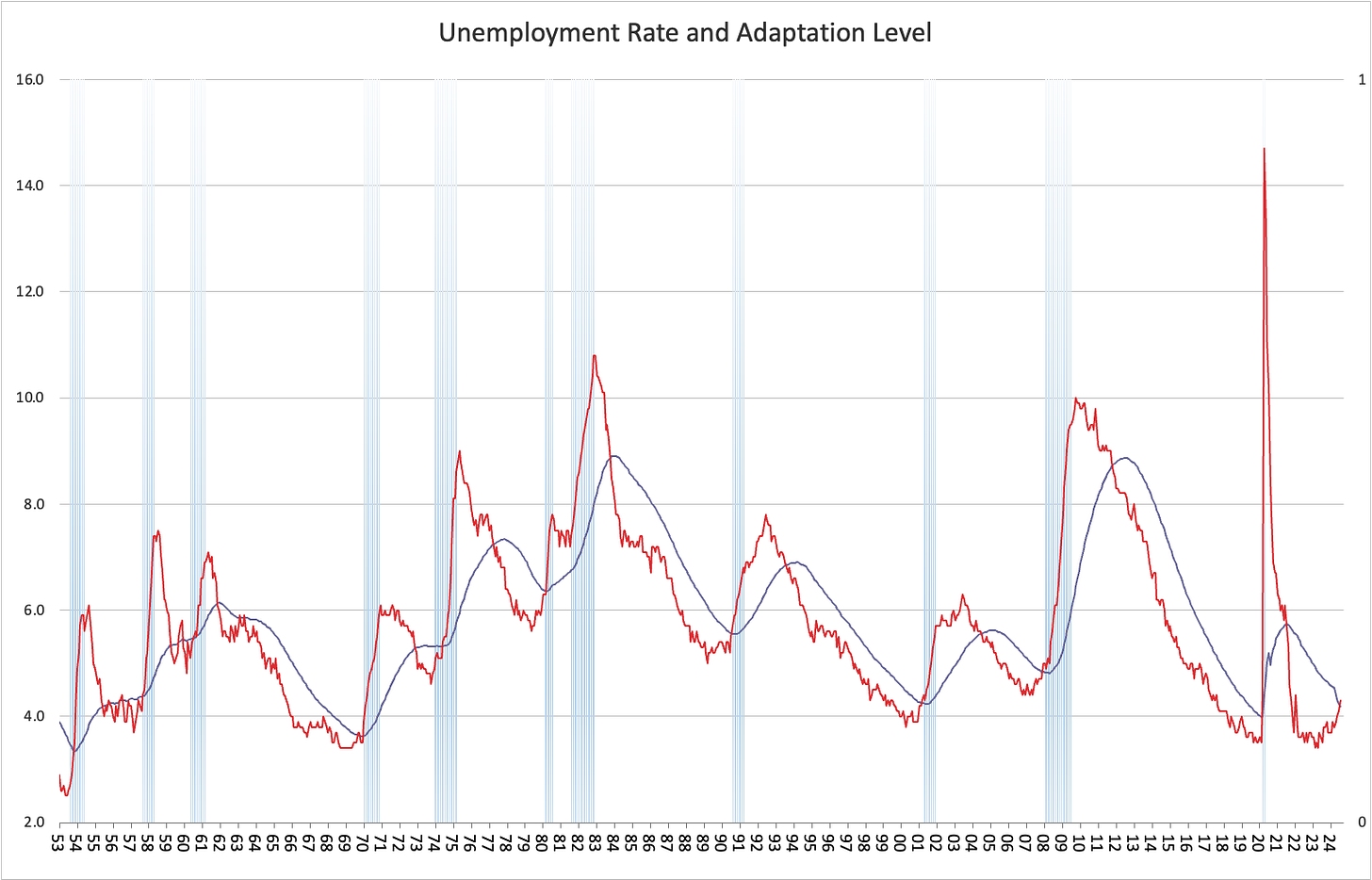

Note below that the economy has never failed to go into recession in short order after the actual unemployment rate crosses above the adaptation level in my model of how confidence drives the business cycle. The July unemployment rate was 4.3 percent, slightly higher than the adaptation level of 4.18.

For the background on my theory of confidence or “animal spirits,” see my post, “Whither ‘animal spirits.” We are at the onset of self-organized criticality, where a self-reinforcing negative feedback loop between confidence and economic decisions begins to take the economy down.

As Peter of “Game of Trades” says, there may be one more micro-bubble in the stock market, but playing it is playing with fire.

Have a great weekend! Positive thoughts for peace!