Eliminate the income tax? Eliminate the federal debt?

some big ideas are floating around; one is really good; a couple are bad

Greg Hunter interviews Martin Armstrong on the possibilities of (1) eliminating the income tax by replacing it with tariffs or a national sales tax and (2) swapping the national debt into equity coupons. As the latter is the only viable idea, I will comment on it first.

Martin Armstrong recommends offering dollar-for-dollar coupons for the principal of the nation’s Treasury debt that could be spent or invested in US-dollar private equity or debt. He contends that this would induce an investment boom in America, as foreign debt holders would face significant transaction costs if they desired to convert the coupons into non-dollar funds to be applied elsewhere. They would have to buy dollar assets and then sell them into the target currency.

Armstrong maintains that the corporate tax rate should be reduced to 15 percent, which would put it below China’s 25 percent, which is approximately the average corporate tax rate in the world. This would drive international businesses to the US, as they always look for the lowest-cost place to open new production facilities. This low corporate tax rate would do much to offset high American labor costs.

This is about the only way out of our debt without a hyperinflationary default and a probable world war. The Treasury would then issue fiat currency without the runaround involved with issuing debt. Interest payments on the debt, which are now greater than the Department of Defense budget, would no longer be made.

As Armstrong has repeatedly pointed out, the demand for a country’s goods and services determines the demand for its currency, not whether it is backed by a metal. Japan and Germany have had strong currencies in the postwar era without backing them with gold.

The terms of the exchange might not be dollar-for-dollar, as foreign holders of the debt might demand better terms for such a risky deal.

This is the kind of deal that corporations make when they go bankrupt, so Trump would be an excellent person to negotiate it.

Of course, if one of the goals is to stop US-China decoupling—which should be one of the goals—China would need to be open to reinvesting some of its $798 billion in Treasuries in the US, perhaps in automobile manufacturing plants. US politicians would need to welcome them, as we have done the Japanese and German manufacturers.

Countries that trade are biased toward peace. Decoupling (trade war) will lead to a hot war. It’s as simple as that.

The idea of replacing the income tax with tariffs is so bad I will only say it would turn America into a Venezuela faster than a Commie-la-Harris administration ever could. American industries would lose competitiveness faster than a speeding bullet to the brain. The retaliatory tariffs would guarantee a stagflationary depression with consumers screaming and running for the border to Mexico—to leave.

A similar idea is replacing the income tax with a national sales tax, which I touched on a few days ago. It is regressive and would do much to destroy the strong American consumer and increase inequality in a society that is already far too unequal for its own good.

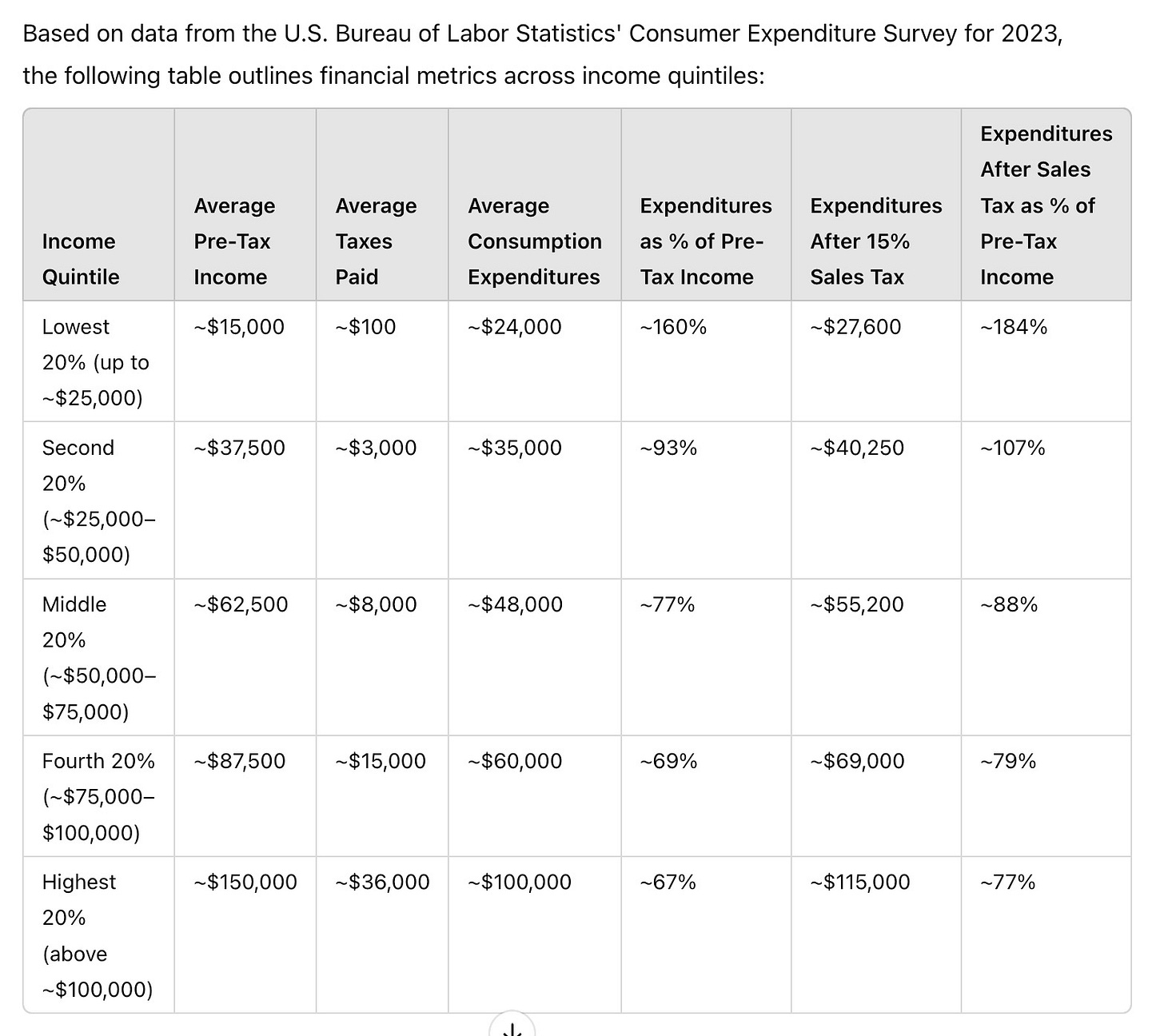

I asked GPT-4o to do a little research.

The table shows the US's average pre-tax income and average taxes by quintile. Consumption expenditures are shown as a percentage of pre-tax income before and after a 25 percent sales tax is levied.

The bottom 40 percent of income earners would have negative savings with the 15 percent national sales tax. From the middle up, consumption takes a larger share of pre-tax income.

Even with exemptions for food and shelter, the effects would be highly regressive, resulting in lower consumption as households spent less to save. Consumption as a percentage of GDP would probably decline from its current levels of about 68 percent.

US inequality has increased since 1980, when Reagan substantially cut top marginal income tax rates, and union-busting activities increased.

It would not make sense if the US were trying to swap out its federal debt for equity or private debt investments to destroy the American consumer at the same time. A lower corporate tax rate and significant deregulation of small businesses would enable healthy demand and innovation to continue in the American economy, with American consumers benefiting from free trade.

Pray for peace! The Neocons, who control the Democrats, want war!