For new readers, please consult “Whither animal spirits” below for the theory behind my confidence indicator cited in The Wall Street Journal and ZeroHedge (although I am now canceled at both, as my views are apparently too extreme).

Whither 'Animal Spirits'?

According to the Michigan Consumer Sentiment Series, confidence is at record lows. But a measure of confidence or “animal spirits,” as Keynes called it, that I developed in the 1990s — that was featured on the front page of the Wall Street Journal, February 20, 1998 — is now showing very healthy “animal spirits.” So which one is right?

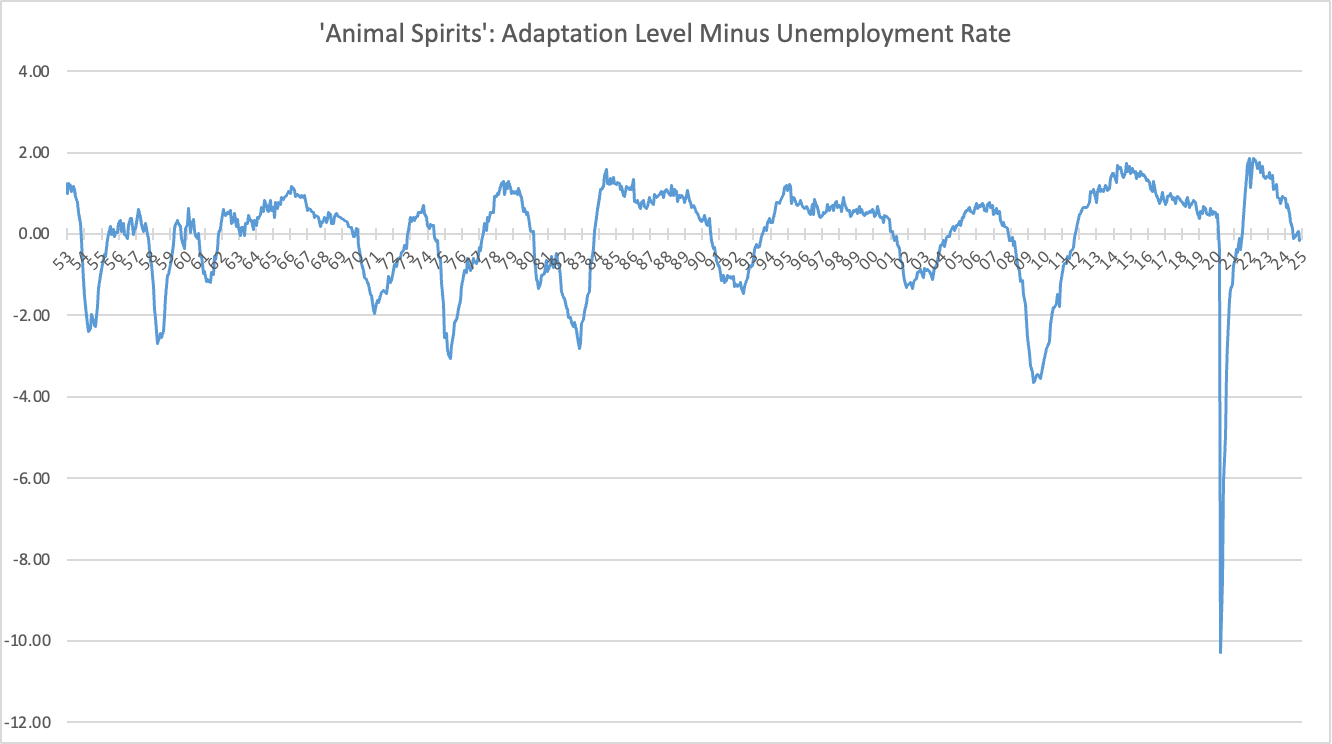

With this morning’s unemployment rate report of 4.2 percent, my confidence metric has once again turned negative. The current rate of 4.2 percent exceeds the adaptation level of 4.04 percent, which is an exponential moving average over the past four years.

Over the past fifty years, every time this has happened, the economy has gone into recession as millions of contractionary consumption and production decisions become a “self-fulfilling prophecy” in a process physicists call self-organized criticality.

The economy will probably roll over into recession in 2025. There were a couple of instances of reversal from touching the zero line in the late 1950s and early 1960s, but none since then.

Subtracting the current rate from the adaptation level yields a confidence metric, like the Michigan series.

My “animal spirits” measure is a better predictor of recessions than the Michigan consumer sentiment survey shown below, which has only a loose relationship between the indicator’s level and recessions.

Buckle up!

Pray for peace!