I was expecting a miraculous 4.0 percent unemployment rate, but the BLS settled for 4.1 percent, which does not invalidate my recession forecast.

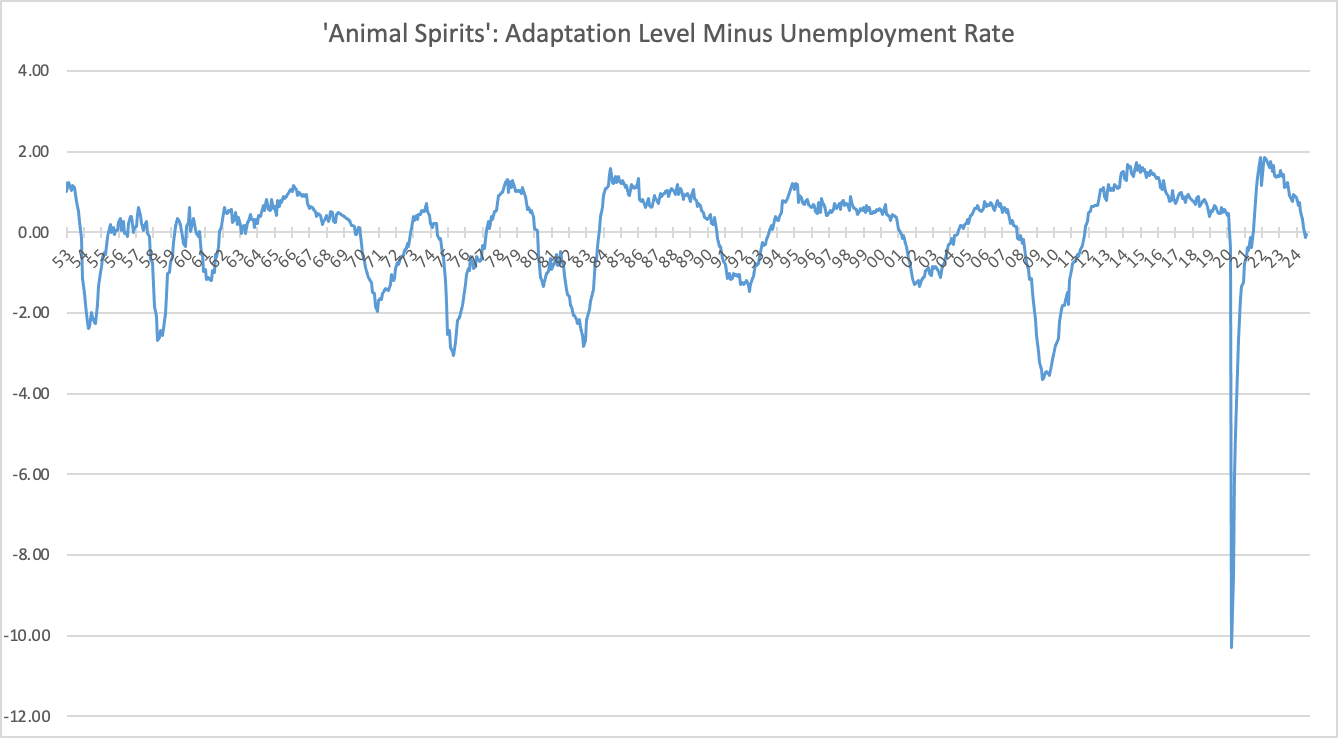

For newcomers, see my article “Whither ‘animal spirits,’” below for the theory. Whenever the unemployment rate rises above the level of our recent experience, our adaptation level, we start to feel less confident and spend less, creating a “self-fulfilling prophecy” of declining incomes and production. Conversely, as long as the unemployment rate is below what we have in memory, we feel fine.

Confidence is determined relative to recent experience. This follows from the first law of psychology, the sensitivity to adaptation level.

The graph shows, in minute detail, that the unemployment rate has risen above the adaptation level. Every other time this has happened, a recession has followed.

We obtain a confidence metric if we subtract the unemployment rate from the adaptation level. This metric's confidence level is now slightly negative, below the zero line, and will become increasingly so if we follow previous patterns.

For comparison, here is the Michigan Consumer Sentiment survey. It is not as good a predictor of recession as my “animal spirits” indicator. It is trending upward but is at levels that have previously been associated with recessions. In particular, the current pattern resembles the 1980-81 upturn just before the severe 1981-82 recession.

Here is my intellectual autobiography of my academic research career, which I left to go into decision science with some of the world’s largest banks. It was also a lot more fun.

Whither 'Animal Spirits'?

According to the Michigan Consumer Sentiment Series, confidence is at record lows. But a measure of confidence or “animal spirits,” as Keynes called it, that I developed in the 1990s — that was featured on the front page of the Wall Street Journal, February 20, 1998 — is now showing very healthy “animal spirits.” So which one is right?

Pray for peace! No fear! Do not comply!